All services

Latest News

Engineering insurance

What is Engineering Insurance

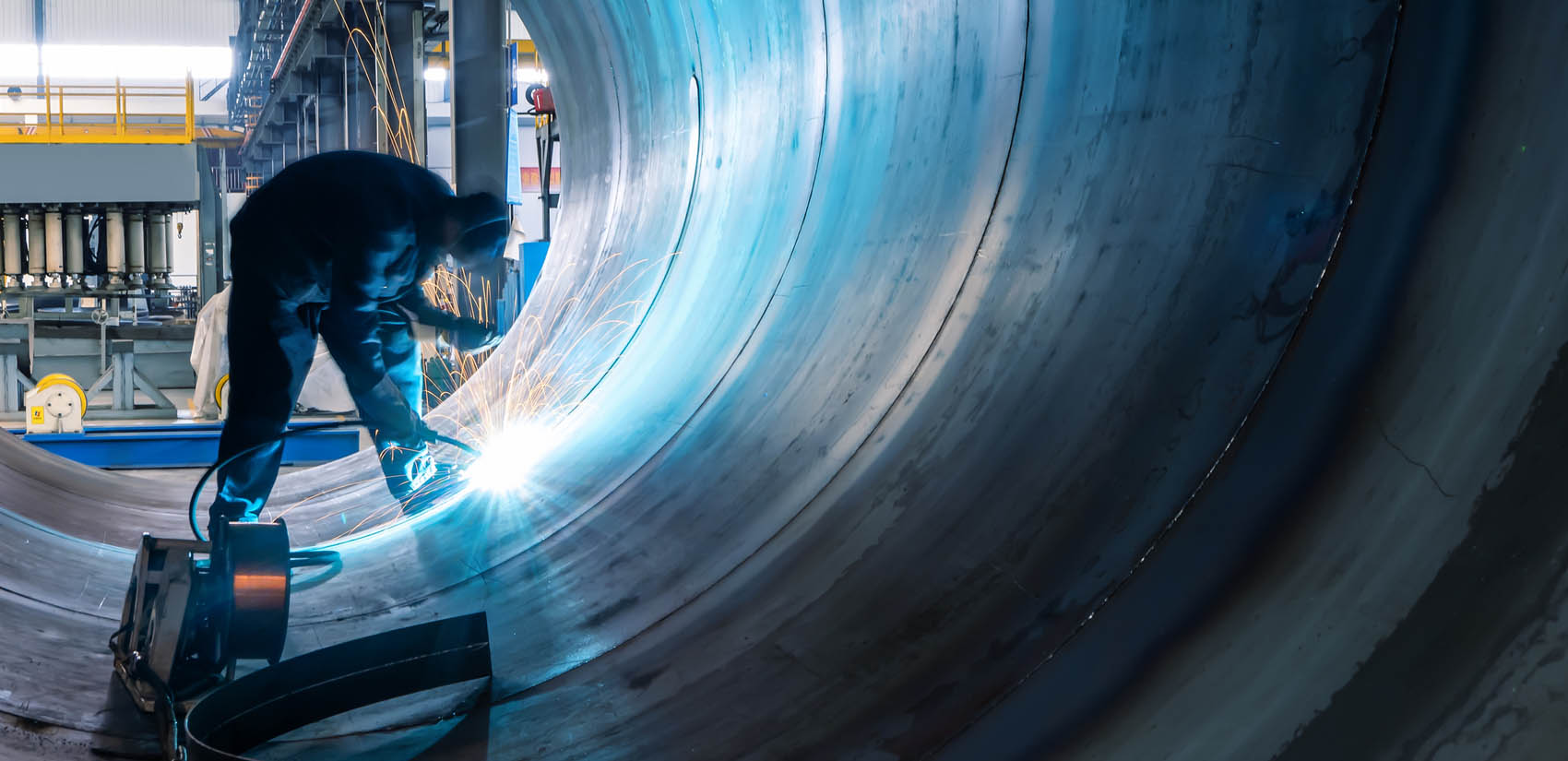

This type of cover aims to support the vital structures around all types of engineering firms, regardless of type and size. Often using complex machinery and intricate systems to control that machinery, engineering firms are sometimes at the mercy of technology, the weather and even just bad luck.

Engineering is a vital industry that is critical to any society’s infrastructure and often involves the use of high-value, systems and business-critical equipment. Unforeseen breakdowns and electrical or mechanical faults can result in business interruption and regardless of your trade or size of the operation you are running, unforeseen accidents in your factory can cost the business heavily in downtime and financially.

As such, having the best insurance cover in place to protect these crucial systems is important to ensure your business becomes more robust when faced with such challenges.

What does Engineering Insurance include?

- Employers Liability

- Public Liability

- Bespoke cover for both owned and hired plant machinery.

- Protection for computer systems and electronics.

- Access to experienced team advisers.

- Claims support

- Professional indemnity

Engineering Inspections

We also understand the legal implications of engineering firms hence why we can facilitate statutory inspections to your equipment and machinery so that your duty to remain legally compliant with your plant can coincide with your insurance policy. This gives you the comfort and freedom of managing mechanic operations and procedures and anything else that could go wrong in the business under one single, simple policy.

The range of equipment that needs to be inspected on a regular includes:

- Pressurised boiler systems

- Lifts, car parking systems and window gantries

- Pressure and compressor systems

- Any machinery that uses hydraulics, chains, ropes or wires.

- Electrical installations

- Forklift trucks, cranes and any other lifting equipment

Having a proactive approach to safety will significantly reduce the risks, both in the short and long term. At Eaglemat, we can help build a bespoke insurance for you covering all of the key aspects your business requirements thereby protecting your clients, employees, machinery, buildings, assets and financial stability should anything happen.

At Eaglemat, we bring in-depth knowledge of your sector and work with a carefully selected panel of market-leading insurers and specialist providers to find the right cover for you. Let us handle the hard work so you can focus on what matters most. For a personalised quote, give us a call on 0116 507 8701 or simply fill out the form below — we’re here and happy to help.